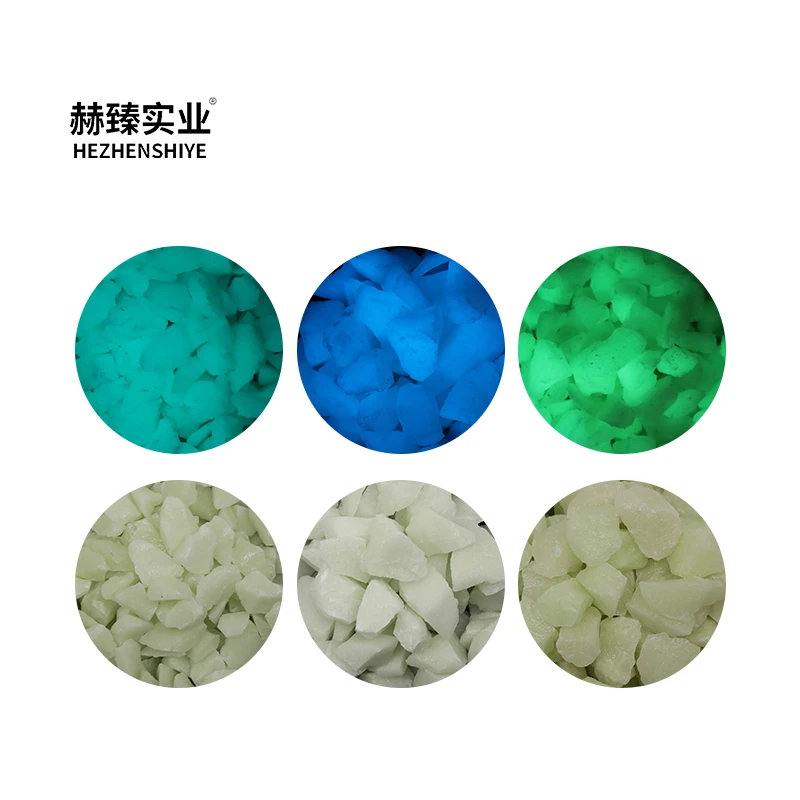

Hezhen 1-3mm luminous stone building with luminous gravel fish tank landscape with high luminous stone

2025.03.06

Bentonite, a naturally occurring clay with unique properties, has become a cornerstone in various industries, from construction to pharmaceuticals. Understanding the cost dynamics of bentonite is crucial for businesses aiming to leverage its characteristics effectively. This article delves into the factors influencing bentonite pricing, providing insights based on experience, expertise, authoritativeness, and trustworthiness.

Environmental and regulatory considerations are increasingly important in the cost structure of bentonite. Stringent environmental regulations can escalate operational costs, impacting the final product price. Companies that invest in compliance and sustainable practices may include these costs in their pricing strategies. However, these companies also build trust and credibility, appealing to ecologically-conscious consumers who prioritize sustainable sourcing. Innovation within the bentonite industry can alter cost dynamics significantly. Research and development aimed at finding new applications and improving existing processes can lead to cost reductions or justify higher prices for enhanced versions of bentonite. Businesses who stay at the forefront of such innovations not only benefit economically but also position themselves as industry leaders. Supply chain efficiency also affects bentonite pricing. Efficient logistics can reduce unnecessary costs, making bentonite more price-competitive. Conversely, disruptions in the supply chain, such as natural disasters or political unrest, can lead to price volatility. Companies should invest in stable and reliable logistics networks to minimize risk and ensure consistent pricing. In conclusion, the cost of bentonite is not merely a function of market rates but a complex interplay of quality, geography, technology, demand, regulations, innovation, and logistics. Businesses dealing in bentonite should adopt a comprehensive approach, considering all these factors to optimize their cost strategies effectively. By doing so, they can ensure a competitive edge, access to premium quality, and alignment with socio-environmental responsibilities, ultimately cementing their trustworthiness and authoritativeness in the market.

Environmental and regulatory considerations are increasingly important in the cost structure of bentonite. Stringent environmental regulations can escalate operational costs, impacting the final product price. Companies that invest in compliance and sustainable practices may include these costs in their pricing strategies. However, these companies also build trust and credibility, appealing to ecologically-conscious consumers who prioritize sustainable sourcing. Innovation within the bentonite industry can alter cost dynamics significantly. Research and development aimed at finding new applications and improving existing processes can lead to cost reductions or justify higher prices for enhanced versions of bentonite. Businesses who stay at the forefront of such innovations not only benefit economically but also position themselves as industry leaders. Supply chain efficiency also affects bentonite pricing. Efficient logistics can reduce unnecessary costs, making bentonite more price-competitive. Conversely, disruptions in the supply chain, such as natural disasters or political unrest, can lead to price volatility. Companies should invest in stable and reliable logistics networks to minimize risk and ensure consistent pricing. In conclusion, the cost of bentonite is not merely a function of market rates but a complex interplay of quality, geography, technology, demand, regulations, innovation, and logistics. Businesses dealing in bentonite should adopt a comprehensive approach, considering all these factors to optimize their cost strategies effectively. By doing so, they can ensure a competitive edge, access to premium quality, and alignment with socio-environmental responsibilities, ultimately cementing their trustworthiness and authoritativeness in the market.